Captive Product Pricing

What is captive product pricing?

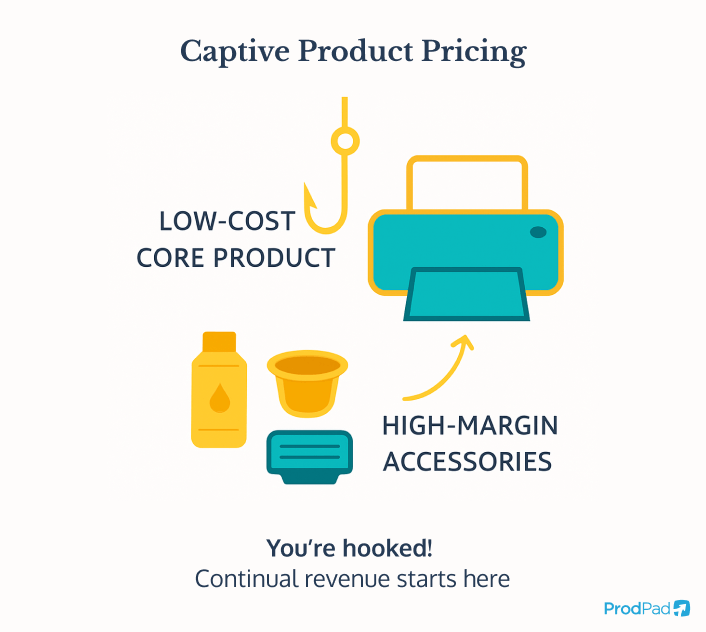

Captive product pricing is a pricing strategy where the core product is sold at a competitive or even loss-leading price, while the complementary products that are required to use it effectively are sold at a higher margin.

Think of it like baiting a hook. You draw customers in with a tempting deal on the main product, then generate ongoing revenue through the indispensable extras. It’s not just a clever pricing trick – it’s a long-term play to lock in customers and build a recurring revenue model.

This model is commonly seen in industries ranging from tech gadgets to coffee machines and SaaS platforms. When done right, captive product pricing creates a dependable stream of income after the initial sale, boosting customer lifetime value and creating a stronger financial backbone for your product strategy.

Get the full lowdown on all your product pricing options. Read Product Pricing Strategies: Choosing the Right Approach for You

What is a captive product vs a core product?

To really get the concept, you need to understand the difference between the two types of products in this pricing relationship.

The core product is what the customer initially buys. It’s the hero, the thing you promote, and usually the cheaper-looking deal. This is what gets the customer through the door.

The captive product is the unsung hero – or the hidden cost. It’s the consumable, accessory, or add-on that only works with the core product and is necessary for its continued use or maximum utility. The catch? The customer can’t easily substitute it with a competitor’s version.

A classic example is a printer (core product) and its specific ink cartridges (captive product). You can’t just jam any ink in there – you need the brand’s own cartridges. Similarly, a streaming device might require a paid subscription or exclusive content purchases to be functional.

This model isn’t just for physical products. In SaaS, the core product might be a basic platform, while captive features could be advanced modules, API access, or additional seats.

Where did captive product pricing come from?

Captive product pricing has a long history and a very famous origin story: the razor and blades model. Gillette, back in the early 1900s, pioneered the idea of selling razors cheaply (or even giving them away) and making money off the razor blades that customers had to keep buying. This “give away the razor, sell the blades” approach became a business school staple.

Since then, the model has evolved but stuck to its core principle: low entry price, high ongoing cost. It’s been adapted by companies across industries and is now embedded in everything from kitchen appliances to software ecosystems. The tech world has embraced captive pricing in new ways, especially with proprietary platforms and locked-in subscriptions.

Why is captive product pricing important?

Captive product pricing matters because it fundamentally reshapes how companies think about revenue. Rather than a one-time transaction, it shifts the model toward repeat business and customer retention. This is especially critical in markets where customer acquisition costs are high and margins are thin.

When you reduce the cost barrier for the initial product, you attract a larger customer base. Then, by designing a product ecosystem where ongoing purchases are necessary, you create a sustainable and scalable revenue stream. This turns a simple transaction into a long-term relationship.

For Product Managers and Heads of Product, captive product pricing can be a strategic lever. It forces you and the team to think beyond the first sale and focus on how to deliver continual value that customers are willing to pay for.

What are the pros and cons of captive product pricing?

Like all pricing strategies, captive pricing comes with its own set of trade-offs. When executed well, it can be a powerful growth engine. When done poorly, it can backfire spectacularly.

Advantages of captive product pricing

One of the major advantages is recurring revenue. Instead of relying solely on new customer acquisition, you generate income from existing users over time. This improves forecasting, boosts lifetime value, and often leads to more stable cash flow.

It also allows companies to price their core products competitively, making them more attractive in the marketplace.

Disadvantages of captive product pricing

But there are downsides. Customers may feel exploited if they perceive the captive products as overpriced or unfairly restricted. Transparency is critical here. The moment customers feel trapped, they start looking for escape routes – and they’ll share their frustration online.

Another risk is innovation stagnation. If a business becomes too reliant on captive revenue, it may deprioritize improvements to the core product, putting long-term growth at risk.

And then there’s the compliance angle: regulators are increasingly interested in pricing practices that limit consumer choice or promote monopolistic behavior.

What’s the psychology behind captive product pricing?

Captive pricing is a psychological play as much as a financial one. It taps into how customers make decisions, and how they evaluate costs over time.

First, there’s the foot-in-the-door effect. By lowering the barrier to entry with a cheap core product, you increase the chances of conversion. Once customers are in, they’re more likely to accept ongoing costs, especially if those add-ons feel small or manageable in isolation.

Then there’s the sunk cost fallacy. Once people have invested in a core product, they often feel emotionally and financially committed. They don’t want to “waste” that investment by switching to a new system, even if it might save them money in the long run.

Finally, price anchoring plays a role. If the core product is surprisingly affordable, customers may mentally benchmark future purchases against it and undervalue how much they’re actually spending over time.

How does captive product pricing work in SaaS?

In SaaS, captive product pricing often shows up as platform pricing models where the base subscription is competitively priced, but critical features, integrations, or usage limits push customers toward additional purchases.

A common example is offering a “Starter” tier with limited functionality – say, a limited number of users, restricted API access, or capped usage metrics. Customers may quickly realize that to extract meaningful value, they need to upgrade to a higher tier or purchase add-ons. These add-ons might include advanced analytics, more data storage, premium support, or integration with third-party tools.

Another example is modular SaaS, where the core product offers a basic workflow or service, but modules like AI-powered features, advanced security, or automation capabilities are sold separately. Once teams are integrated into your platform, they often have little choice but to buy these modules to scale effectively.

The key is designing your SaaS offering so that the core product is genuinely valuable on its own, while the captive components feel like natural, necessary enhancements – not ransom.

Find out all your product pricing options for a SaaS product

How do you implement captive product pricing?

Rolling out a captive product pricing strategy isn’t something you slap on overnight. It requires coordination across product development, pricing, marketing, and customer success. It all starts with understanding your product ecosystem.

First, you need to design a compelling core product that creates enough value on its own to justify purchase. Then, you must identify what features, services, or add-ons can be offered as captive products. These must be essential enough to drive repeat purchases, but valuable enough that customers are willing to pay for them.

Make sure you establish clear pricing tiers. The core should be priced attractively to draw people in, while the captives should be positioned as worthwhile enhancements rather than gouging mechanisms.

Transparency is key: make it obvious that the full experience requires additional purchases, and highlight the value they bring.

Also consider compatibility and interoperability. If your goal is to drive captive purchases, limiting third-party alternatives might be tempting. But do it with care – and with the user experience in mind.

What are the challenges of implementing captive product pricing?

The most immediate challenge is customer trust. If buyers feel misled about the true cost of ownership, you risk long-term damage to your brand. No one likes to feel duped.

There are also technical challenges. Your product must be designed in a way that supports locked-in components or services without compromising usability. That often means coordination between Engineering and Product Teams, and possibly added complexity in your tech stack.

Pricing strategy itself can become a minefield. You need to strike a balance between affordability, value perception, and profit margin. Misjudge it, and you might lose customers altogether.

Dive deeper into the principles of setting your overall pricing strategy

And let’s not forget compliance. In tightly regulated markets, practices that seem like good business can quickly turn into legal liabilities. Make sure your Legal Team is on board from the start.

Examples of captive product pricing

One of the most well-known examples is printers and ink cartridges, as we mentioned before. Many printers are sold at razor-thin margins or even at a loss, while replacement cartridges are expensive, proprietary, and frequently needed.

Another popular case is coffee machines and pods. Nespresso and Keurig have built empires on the back of this model, offering sleek machines at a low cost and raking in profits from branded pods.

In the digital world, game consoles and exclusive games or online subscriptions are a perfect fit. The console might be competitively priced, but you need branded controllers, paid subscriptions for online play, and proprietary games to really use it.

SaaS is catching up, too. Smart home devices often require a paid subscription to access full features or data storage. Think Ring doorbells or Nest thermostats.

Captive pricing vs. other pricing models

There are several other models out there that often get conflated with captive pricing, but each has its nuances.

Freemium models offer basic features for free, with premium features behind a paywall. This differs from captive pricing, where the core product is usually not free and the add-ons are necessary for continued use.

Bundling groups several products together at a discounted rate. It’s more about convenience and value than long-term monetization through required add-ons.

Subscription pricing creates recurring revenue through time-based access to a service. While subscriptions can be part of a captive model, they’re not the same thing. Subscriptions are opt-in by nature; captive pricing often relies on necessity.

Check out our glossary entry on pricing models for more comparisons.

What are the ethical considerations for captive product pricing?

Captive pricing can walk a fine ethical line. Done transparently, it’s just smart business. Done deceptively, it can feel like a trap.

Transparency is everything. Customers must know what they’re getting into. Hiding the true cost of usage damages trust and can lead to negative reviews, churn, or even regulatory intervention.

Avoid tactics like forced obsolescence, where you degrade the performance of the core product over time to drive sales of captives. That’s not just unethical – it’s often illegal.

Ethical captive product pricing respects user autonomy. Your customers should choose to buy your captives because they see value, not because they have no other option.

The future of captive product pricing strategies

As products and platforms become more interconnected, captive product pricing is evolving. We’re seeing hybrid models that combine subscriptions, usage-based pricing, and captive products into a single ecosystem.

AI is playing a role, too. It allows companies to dynamically adjust captive product pricing based on usage patterns, demand, or customer segments. This can increase personalization and improve customer satisfaction – if done transparently.

Find out more about how to price AI products in our free ebook The Product Manager’s Guide to Building AI Products

And some companies are turning the model on its head. By going open and offering compatibility with third-party products, they build trust and differentiate themselves from closed ecosystems.

Captive product pricing isn’t going anywhere. But it’s getting smarter, more nuanced, and more user-centric.

How do you measure the success of a captive product pricing strategy?

Success in captive product pricing isn’t just about revenue. It’s about sustainability, retention, and customer perception.

Start with Customer Lifetime Value (CLV). Are customers spending more over time due to captives? Look at how the captive products extend engagement and increase average revenue per user (ARPU).

Then examine your attach rate: how many customers who buy the core product also purchase the captives? This tells you if your pricing ecosystem is working.

Monitor churn closely. A spike in cancellations or returns might indicate that customers feel tricked or undervalued.

Finally, layer in qualitative feedback. Are customers complaining about being locked in? Do your captives feel like value-adds or ransom notes?

Give your product strategy and planning the home it deserves

Start a ProdPad free trial and see what a true Product single source of truth looks like in action