Product Comparison Chart [with Template]: Tips & Examples

Before you decide what to build next, it pays to know what else is out there. A solid product comparison chart helps you pull together a bunch of intel on the other solutions in the market so you get the full picture.

Done right, a product comparison chart should take you beyond surface-level analysis – it’s not just about features, but about understanding your competitors’ strengths, weaknesses, market presence, and customer appeal.

But where do you start? Let us show you how to build a truly insightful product comparison chart that you can use to inform your product decision making.

You can either download our template now or after you’ve read through the article – just be sure to get your copy so you don’t have to start from scratch.

What is product comparison?

Product comparison is the practice of evaluating multiple products side-by-side to understand how they stack up against each other. As a Product Manager, it helps you and your team make informed strategic decisions about positioning, feature development, pricing, and go-to-market plans.

Product comparison usually forms part of your wider competitive product analysis, helping you to boil down all your research into a side-by-side view so you can easily spot the differences, similarities and opportunities between your own product and others.

What is a product comparison chart?

A product comparison chart is a structured document that helps you capture and visualize how your product compares to competitors across a wide range of dimensions – not just features, but company size, pricing, customer sentiment, and more. It’s deeper than a feature comparison grid and is intended to help you make smarter product decisions.

Of course, your own product doesn’t necessarily have to feature in the product comparison chart. You can use a product comparison chart to evaluate a new product or market you’re considering. Before making any product development decisions, can you spot any gaps or opportunities when you compare the existing products in the space?

Usually product comparison charts are internal documents that offer a brutally honest assessment of your product and competitor products that may well highlight some holes in your offering and some clear ways in which competitors win. But that’s OK.

A product comparison chart is not typically what you’d publish on your website or put front and center in your sales collateral. No. There you would massage the truth a little – try and put your best foot forward, downplay the weaknesses and champion the strengths.

A product comparison chart needs to be the no-holes-barred, full and honest truth – it’s your space to get real. You want the cold hard truth captured for the whole team to see, so you can start to plug any gaps, boost your differentiation and drive your product forward.

Why should I use a product comparison chart?

To put it simply – because as a Product Manager, you can’t afford to build in a vacuum. No matter how great your product is, your customers are evaluating it alongside other options. You’re not the only solution on the table – and pretending you are is a dangerous blind spot.

A product comparison chart forces you to look outward. It equips you to understand the landscape your product lives in: who else is solving the same problems, how they’re positioned, how they price, what customers love (or hate) about them, and how they’re evolving. This level of competitive intelligence isn’t a nice-to-have – it’s the bedrock of good decision-making.

Without a product comparison chart, you risk making strategy calls based on assumptions. That can lead to mismatched messaging, mispriced features, or roadmap investments in the wrong areas. It’s like building a go-to-market strategy with your eyes closed.

A well-maintained product comparison chart gives you the lay of the land. It’s your tool for:

- Understanding where you sit in the competitive landscape

- Identifying feature gaps and opportunities

- Uncovering pricing strategies that win (or lose) customers

- Tuning your messaging to better resonate

- Supporting product strategy conversations with evidence

If you’re making product decisions based on assumptions, you’re already behind. A well-maintained product comparison chart keeps you aligned and armed with real insight.

When should I use a product comparison chart?

There’s no bad time to get clear on the competition, but there are definitely moments when a product comparison chart becomes mission critical. If you’re launching into a new market, scoping a fresh product, or even just reassessing your roadmap, having a detailed view of the competitive landscape will give you the strategic advantage.

You should reach for your comparison chart:

- When entering a new market or launching a new product

- During strategic planning sessions

- Before roadmap reviews

- When refreshing your pricing model

- When prepping for investor meetings or board reviews

But here’s the thing – this isn’t just a one-and-done exercise. The market moves fast. Competitors evolve. New players enter. Your own product changes. So, your product comparison chart needs to keep up.

Think of it like this: your product comparison chart is a living, breathing source of truth. Keep it updated regularly – quarterly is a good rule of thumb – and make sure it reflects the latest intel from your team. That way, when it comes time to make big calls, you’ve got the full context, not a snapshot from six months ago.

A stale chart won’t just be useless – it might lead you in the wrong direction.

Who should complete a product comparison chart?

Product comparison charts are usually led by a Product Manager, but ideally it’s a cross-functional effort. Marketing can feed in positioning and messaging analysis. Sales can provide competitive battlecards and objections. Customer Success might surface insights about what prospects are saying.

The best charts bring together insight from across your GTM and Product Teams.

Another advantage of pulling in multiple teams when compiling your product comparison chart is that they will feel a degree of ownership – or at least investment – in the document. This increases the chances of them a) reading the whole thing, absorbing the information and using that to inform how they speak to prospects, talk to customers etc, and b) it will make them more likely to feed in new intel they glean, whenever they glean it. That way, it’s not all on you to keep the product comparison chart up to date.

Which brings us onto…

How often should I update my product comparison chart?

Your product comparison chart is not a one-and-done exercise (we’ve already said that) – it’s a living, evolving source of competitive intelligence that should adapt and grow alongside your product and your market.

Just like your roadmap, your product comparison chart needs regular attention if it’s going to stay relevant and useful.

Think about how often your competitors launch new features, adjust their pricing, update their positioning, or make headlines with funding or acquisitions. If your chart doesn’t reflect those changes, you’re operating with stale data. That’s not just unhelpful – it can be actively misleading.

As a general rule, aim to update your product comparison chart at least once a quarter. But don’t be afraid to revisit it more frequently, especially if:

- A major competitor makes a big product announcement

- You’re entering a strategic planning cycle

- You hear something new from your Sales or Customer Success Teams about how competitors are being perceived

Treat it as a dynamic asset that your team can rely on. The more consistently you update it, the more value you’ll get – not just as a historical document, but as a real-time strategic tool you can use to make better, faster product decisions.

What should be in a product comparison chart?

There’s no rigid industry standard for what has to go into a product comparison chart – and that’s a good thing. The point isn’t to tick every possible box, but to gather the insight that’s most useful to your team. Include whatever will help you make better product decisions: what you need to know about your competitors, how they’re positioned, how they’re perceived, and how they’re evolving.

To get the most out of your chart, put yourself in the shoes of your customer. Imagine you’re evaluating a shortlist of tools to solve a problem. What do you care about? What would influence your decision? It might be pricing transparency, ease of integration, customer support, feature completeness, or even just how polished the website and onboarding feel.

A good product comparison chart helps you reflect that buying journey – it lays out the things your customers are considering, so you can see how your product stacks up in a like-for-like comparison. That perspective is invaluable.

We’ve gone ahead and created a downloadable product comparison chart template to act as your starter for 10. Here are some of the sections we included:

Company Details

It’s a good idea to set the scene for each product you’re comparing with a quick company overview – those firmographic stats that help you understand the scale and maturity of each competitor. They could include founding year, number of employees, revenue, and market share.

Mission Statement

Understanding each company’s mission helps you see how they position themselves and who they’re targeting. You can usually find mission statements on a company’s About page, in press releases, investor decks, or even in executive interviews and company blogs. If it’s not explicit, look for repeated themes in how they talk about their purpose or long-term goals.

Market Perception

This isn’t just one row in your product comparison chart, this is a whole section which, read together, should give you a clear sense of how each product is perceived in the market. How well known is the product and what is the general consensus about how useful/desirable it is?

Capturing things like:

- Awareness (high/medium/low): Do you think most people in the relevant market would have heard of this product?

- Review ratings: Pick a review site or take an average from a few. How many stars are being giving this product?

- Customer likes and dislikes (qualitative feedback): Now read those reviews and pull out the common themes. Capture some quick notes on the perceived pros and cons of the product

Product Commercials

Remember, you’re not just comparing the functionality of these competitor products, you also need to examine their business models and the ways they are commercializing their offering to see if there are things you could learn or mistakes to avoid.

In this section capture:

- Pricing model – are they using a subscription model? Are they charging per user or based on usage?

- Pricing plans – Do they offer different tiers? Do you buy modules with add-ons?

- Price – Are they expensive? Relatively cheap?

- Trial model – Do they offer a free trial? Is it a freemium model? Is there no way to self-serve and have a free go?

- Primary acquisition motion – How do people go about buying the product? Do they self-serve and add card details? Do they have to speak to a Salesperson?

Positioning and Messaging

For each product on your product comparison chart, capture the primary promises they make about their product. What are the core benefit statements they are making to the market?

You can glean this from their H1 and tagline, the H2s down their website pages, and generally how they talk about their product across various channels.

This is gold for your marketing team and helps refine your own messaging.

Features and Capabilities

OK, here’s where you get down and dirty – diving into the weeds and comparing all the capabilities each product has.

This is usually the section that needs the most updating, so remember to keep an eye on each competitor’s public roadmap so you don’t miss any major gap closing moves.

Support and Service

Remember, when someone buys a product, they also buy the wraparound services that go hand-in-hand. Sometimes this is where a competitor can really stand out – it’s not unheard of for inferior products to leave their competitors in their dust because they offer top-notch support and customer care.

So don’t forget to evaluate each competitor’s customer service offerings. Compare whether they offer live chat (AI or otherwise), email support, phone lines, dedicated Customer Success Managers, extensive implementation services, extra consultation – the list goes on. Be sure to include whatever is most common in your industry.

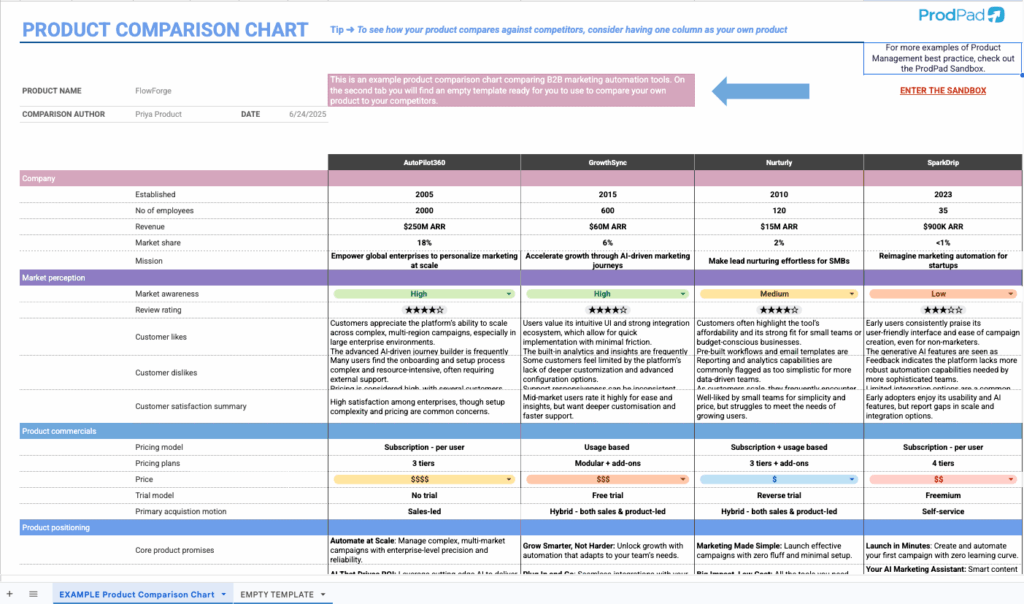

Example of a product comparison chart

If you need to see examples of everything we just covered above, then you’re in luck.

We’ve actually included a completed product comparison chart within our downloadable template so you can see what we mean for each section. Download the template and check out the first tab. We’ve mapped out every element of the product comparison chart for four fictitious marketing automation tools.

Download the Product Comparison Chart Template now

Product comparison chart vs feature comparison grid

You might sometimes see people talking about product comparison chart but what they actually have is a feature comparison grid. There is a difference.

A feature comparison grid gives you a limited view – usually just a list of functionalities and whether or not a product has them. It’s binary. Tick or cross. It doesn’t tell you the full story.

A product comparison chart gives you the context. It helps you understand what the product is, how it’s sold, who it serves best, how it’s perceived in the market, and what customers are actually saying about it. It’s a 360-degree view.

A feature comparison grid is a useful tool no doubt – but it’s often built for external consumption. You’ll find them on marketing pages, in sales decks, or as battlecards that highlight your strengths (and quietly downplay your weaknesses). That’s totally fine – every product needs a polished public face.

But a product comparison chart? That’s internal. That’s where the hard truths live – as we mentioned. It’s where you get to be honest about where you fall short, where competitors might be stronger, and where there are genuine gaps or opportunities to exploit. This is the tool that gives your Product team clarity and insight to make better decisions.

How to make a product comparison chart

Right, it’s time to get started on your own product comparison chart now you know the theory. So where to start?

Tip one – use a template

Don’t try and reinvent the wheel. Move faster by grabbing a template and spend your time gathering the intelligence, not formatting tables. Luckily we have one for you so go ahead and download that now 👇.

Once you have your product comparison chart template, follow these steps:

- Identify your competitors – Who’s in your market or adjacent to it?

- Gather intelligence – Use review sites (like G2, Capterra), LinkedIn, customer feedback, and competitor websites.

- Organize your data – Use the template to input company details, features, pricing, and customer insights.

- Collaborate – Loop in Sales, Marketing, and CS for frontline insights.

- Review and refine – Ensure the data is current and accurate. Sense-check it with your team.

Why should I use a product comparison chart template?

As we’ve already said, using a template will mean you don’t have to spend time thinking about how best to present your product comparison insight – you can instead spend the time gathering that insight and making decisions based on it.

A good template (like ours!) also ensures you’re not missing key areas like customer perception or pricing models – areas too often left out of traditional feature grids.

Best practices for product comparison charts

A product comparison chart is only as useful as the care and attention you put into it. It’s not just about gathering data – it’s about how you interpret, share, and act on that data.

Treat it like a strategic artifact, not just a spreadsheet. When created and maintained well, it can become a trusted source of truth for your team and a springboard for high-impact decisions.

- Keep it honest – Don’t distort data to make yourself look good. You’ll only mislead yourself.

- Focus on insights – This isn’t just a fact sheet. Look for patterns and opportunities.

- Make it collaborative – Involve stakeholders across the org.

- Use it regularly – It’s not a one-and-done document. Keep it alive.

- Connect it to strategy – Don’t just file it away. Use it in roadmap reviews, planning sessions, and pitch decks.

What should I do with my product comparison chart once it’s complete?

This is where the chart stops being a research exercise and starts becoming a decision-making tool. Once your chart is populated with honest, detailed insights, it’s time to put it to work.

First, take time to really absorb what it’s telling you. Where does your product clearly lead the pack? Where are you falling short? Are there recurring patterns in customer sentiment that suggest an underserved niche? These insights are the raw ingredients of your next great product move.

Use this chart to shape your roadmap – not just in terms of building what your competitors have, but in terms of understanding what the market truly values. Maybe you’ve discovered your pricing is totally misaligned with others in your category. Maybe you’re solving a different problem than the rest, and your messaging should lean into that more. The chart gives you a mirror, and it’s one that reflects how the market sees you, not just how you see yourself.

Make sure this product comparison chart is accessible to everyone who needs it – Product, Marketing, Sales, Customer Success. Store it somewhere central (ProdPad’s a great spot!) and make it a living document. Because if it just sits in someone’s desktop folder, it’s not doing its job. Keep it up to date, revisit it regularly, and treat it as a strategic resource that informs how you grow and compete.

Remember: A stale product comparison chart isn’t just unhelpful – it can send you down the wrong path. The magic only happens if you keep it alive and keep learning from it.

You ready to create your own product comparison chart?

Get your copy of our free template and get populating! Good luck. We’ll just pop the download banner here one more time 😉