Product Metrics to Use Instead of Vanity Metrics

Product metrics are the compass of product management. They show how customers interact with your product, what value they get from it, and how those behaviors connect to business outcomes. Used well, product metrics guide decisions, predict growth, and align teams around impact.

What are product metrics?

Product metrics are measurable indicators of customer behavior and value delivery. Good product metrics highlight whether a product is solving real problems and driving outcomes. Vanity product metrics, like DAU or signups without context, may look impressive but don’t reveal whether customers are actually succeeding.

And that’s the catch. While product metrics can steer a team toward smarter choices, the wrong ones can steer you straight into trouble. Vanity metrics are candy for insecure executives. They look glossy in a slide deck, deliver a quick sugar rush, and create the illusion of progress. But they rarely nourish the business. More often, they hide the uncomfortable truths that could drive better decisions and distract teams with surface-level signals instead of meaningful outcomes.

One of the worst offenders is DAU, or daily active users. At some point, teams outside the tech giants decided that copying this product metric was a shortcut to credibility. “Facebook tracks DAU, so we should too.” But context matters. At Facebook, DAU was tied to a network-effect business model that depended on habit formation. In a B2B SaaS tool, a healthcare platform, or a fintech app, DAU might be meaningless. I’ve seen teams trumpet rising DAUs while quietly bleeding out customers on the back end. Churn didn’t make the slides, so it didn’t get attention.

The pattern is consistent across industries. Easy to measure does not mean useful to measure.

The path of least resistance

It’s not hard to see why teams default to vanity metrics like DAU, WAU, NPS, or signups. They’re easy to calculate, easy to explain to non-technical stakeholders, and they look impressive on a chart. They give the illusion of momentum.

But these numbers are deceptive. They don’t reveal whether customers are reaching value. They don’t tell you if the product is solving the right problems. And they often obscure the deeper issues that determine whether a business can survive.

Take BranchOut, the Facebook-based recruiting startup that became a cautionary tale. The team zeroed in on DAU as its defining product metric. Everything was optimized for driving daily logins, mostly by spamming users’ social graphs with invites. On the surface, it worked spectacularly: BranchOut rocketed to 33 million DAUs in under two years and pulled in $49 million in funding. But underneath, the churn rate was catastrophic. Users signed up, got annoyed by the aggressive invites, and abandoned the platform just as quickly as they arrived. As Looker’s founder Lloyd Tabb later put it, BranchOut was “a meteor until they fell to earth” because they mistook DAU growth for sustainable value.

Or look at Zynga, the social gaming company infamous for its obsession with DAUs. Zynga built games engineered for quick hits of engagement and in-app purchases, and the numbers looked phenomenal in the short term. But these tactics masked a brutal truth: players churned en masse once the novelty wore off. Engagement was shallow, not lasting. As gamification expert Yu-kai Chou noted, Zynga’s reliance on vanity metrics came “at the expense of a very high churn…players were burning out and Zynga’s revenue stream dried up with it.”

Vanity product metrics are the path of least resistance because they tell a flattering story. They make leadership feel good, they get boards off your back, and they create a sense of progress. But that path leads you straight past the uncomfortable truths, the ones you’ll have to face eventually when growth falters, investors lose confidence, or customers walk away.

What uncomfortable truths in product metrics look like

If you want to see what’s really happening, you have to ask harder questions.

- Retention and expansion: Are people sticking around, and are they deepening their use?

- Activation: Are they reaching first value, or do they fall off before the payoff?

- Outcome alignment: Does the product metric tie to actual revenue or strategic goals?

Metrics that surface uncomfortable truths force tough conversations. They reveal whether the business is built on sand or solid ground.

Think of Webvan, the dot-com grocery darling that scaled while demonstrating failure. During the boom, Webvan dazzled with signups and rapid city expansions. The numbers impressed investors, but each order lost money. The product adoption metric of “customers acquired” was paraded as proof of traction, when in reality the economics were a disaster. As one Sequoia partner admitted, Webvan was “busy demonstrating failure” while scaling out aggressively.

Or Jawbone, the wearables maker that celebrated valuation over customers. The company raised nearly a billion dollars and boasted a $3.2 billion valuation. Those vanity milestones looked fantastic on paper, but they distracted from the fact that customers were unhappy and products were defective. By the time the company faced reality, it was too late to recover.

And even giants fall into the trap. IBM, the enterprise giant that chased EPS at the cost of innovation, is a case in point. In the early 2010s, IBM promised Wall Street it would deliver $20 earnings per share by 2015. That goal, celebrated in investor presentations, was nicknamed “Roadkill 2015” inside IBM because employees knew it meant cutting costs and selling assets rather than innovating. The company eventually had to abandon the goal, but not before damaging morale and momentum. EPS growth looked good on slides but did not equate to a healthy product pipeline.

Uncomfortable truths rarely make for pretty charts. But if you aren’t facing them, you aren’t steering the business. You’re just coasting on appearances.

How to tell if a product metric is value or vanity

A product metric isn’t automatically good or bad. DAU, WAU, signups, or NPS might be the perfect metric for one company and pure noise for another. The difference comes down to whether the metric reflects real customer value in the context of your business model.

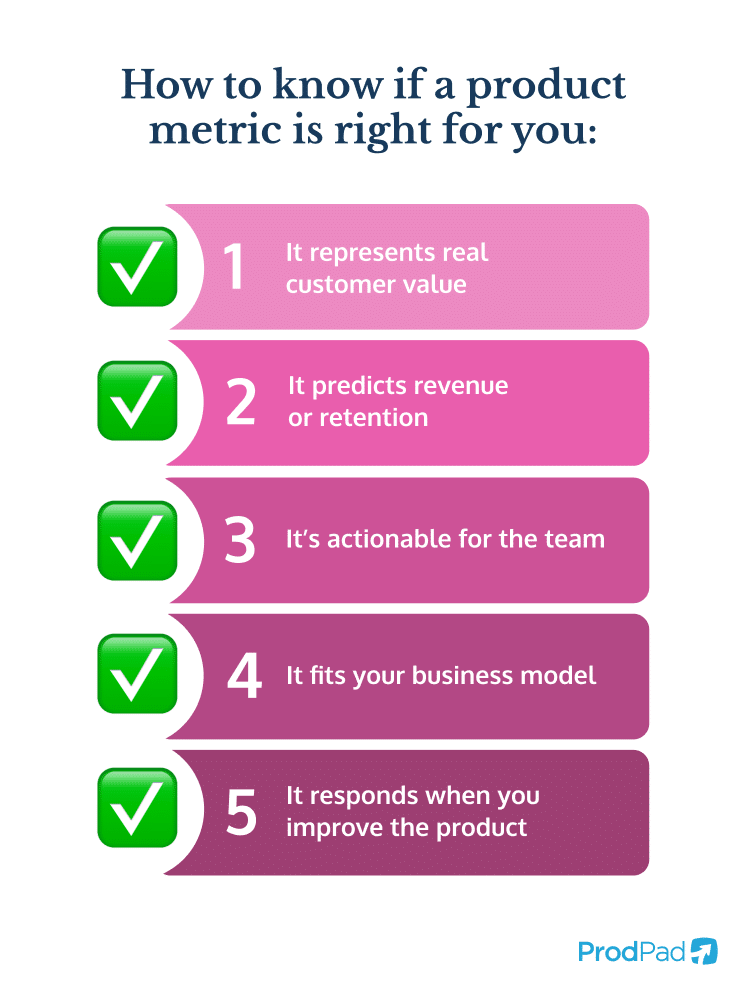

Here’s a simple litmus test you can use to stress-test any product metric:

1. Does it represent real customer value?

If the number goes up, does it mean customers achieved something they care about? For Facebook, DAU makes perfect sense: the business model is built on habit and repeat daily use. More logins equal more ad revenue. But imagine a payroll system. If customers are logging in every day, that’s a red flag. Payroll should be so seamless that users only touch it when necessary. In that case, DAU would be a nonsense metric. A better one might be “% of customers who complete payroll runs without support tickets.”

2. Does it predict revenue or retention?

The right product metric is one that points to your future health. If you can draw a line from the metric to stronger cohorts, higher renewal rates, or longer customer lifetime value, then it’s meaningful. For a subscription streaming service, hours watched per user predicts churn risk. More hours equals more stickiness. But BranchOut’s DAU spikes never correlated with retention, so it was a poor predictor of sustainability.

3. Is it actionable for the product team?

A good metric is one you can move through product or process changes. If the metric dips, it should spark clear next steps. Signups without context aren’t actionable. But “% of new users who reach first value in seven days” tells you exactly where to focus: onboarding, guidance, and first-use experience.

4. Is it aligned with your business model?

Product Metrics have to fit the way your company creates and captures value. A B2B enterprise SaaS company doesn’t need DAU to succeed. It needs renewals, expansion, and feature adoption because revenue is tied to annual contracts and account growth. Contrast that with ad-driven platforms like TikTok, where DAU is directly tied to monetization. Borrowing another company’s success metric without aligning it to your own model is a recipe for vanity.

5. Does it move when you improve the product?

Finally, a good product metric should be sensitive to your efforts. If you redesign onboarding and activation rates climb, that’s a clear signal. If the number only moves with ad spend or quarterly seasonality, it’s not useful for guiding product decisions. That’s why NPS is problematic… it lags by months, and responses often reflect mood more than product value.

If your metric ticks these boxes, it’s a value metric. If not, it’s probably candy.

Link your product metrics to real outcomes with our Ultimate Collection of Product OKR Examples.

Moving from activity metrics to outcome-based product metrics

Here’s the critical shift: stop measuring activity, start measuring outcomes.

Activity metrics are about what customers do, like how many times they log in, how many clicks they make, or how many invites they send. Outcome metrics are about what customers achieve. Did they solve the problem your product promised to fix?

A customer-led growth approach demands that you measure success by what customers accomplish, not just what they touch.

Consider YouTube, the video platform that swapped clicks for watch time. For years, its algorithm rewarded views and clicks. The result was clickbait galore. People clicked, bounced, and left unsatisfied. In 2012, YouTube made the gutsy call to reorient everything around watch time. Views dropped by 20 percent overnight, but engagement quality improved dramatically. As their director of engineering explained, continuing to watch was a far better proxy for value than a quick click.

That’s the playbook: measure whether customers hit a meaningful outcome. Not “daily users,” but “% of customers who achieved their business objective this week.”

The process shift

Making this change isn’t just about swapping one product metric for another. It’s a process shift.

It starts with discovery. Talk to your customers. Understand their jobs-to-be-done. Pinpoint the exact moments when they achieve success.

Then, map your metrics to those moments. If activation is the first time a new customer runs a successful report, then that’s the metric to track, not raw signups.

Bring cross-functional teams into this. Product, customer success, and even execs need to agree on what “real goals” look like. Otherwise, the marketing team will still optimize for clicks, while sales trumpets signups, and you’ll be back in vanity land.

And accept that outcome metrics often have a lag. Retention or expansion numbers take longer to surface. But that lag is exactly why they’re predictive of revenue growth. If you want to see the future, look at retention cohorts, not yesterday’s DAU spike.

Think of Microsoft, the tech giant that reinvented itself under Satya Nadella. The old guard bragged about Windows licenses shipped. Nadella pivoted the company to track active usage of its cloud and Office products. Suddenly, success wasn’t about selling a license, it was about customers using and loving the product. This realignment fueled one of the most impressive turnarounds in tech history.

What good product metrics unlocks

When you shift to value-based metrics, everything changes.

- Clearer prioritization. Roadmap decisions tie back to impact, not optics. It’s easier to kill features that don’t move the outcome needle.

- Honest conversations. You can challenge execs when they push for dashboard candy. IBM learned this the hard way when it chased EPS targets to impress Wall Street, hollowing itself out in the process. Imagine if they had measured innovation and customer outcomes instead.

- Sustainable growth. Companies like Blue Apron, the meal-kit company that turned around by focusing on retention, learned that chasing subscriber counts was a losing game. Their turnaround came when they focused on retention and lifetime value, cutting marketing waste and targeting high-value customers instead. By prioritizing the top 30 percent of customers, they improved retention and stabilized their business.

This isn’t just theory. From eBay prioritizing trust over raw transactions, to Medium optimizing for time spent reading, to Ramp, the fintech upstart that outpaced Brex by rejecting vanity metrics, the companies that win are the ones who pick product metrics that drive decisions, not just egos.

Choose courage over candy

Vanity metrics make you look good. Value metrics make you better.

The real question to ask is simple: does this metric help me make a product decision?

If the answer is no, you’re looking at candy.

If the answer is yes, you’re looking at nourishment.

So here’s my challenge to you: go look at your team’s dashboard this week. Audit every product metric on it. Ask which ones are vanity and which are value. Then have the courage to strip out the candy and chase the ones that actually make your product, and your company, stronger.

Stop chasing vanity metrics. Start building with clarity with ProdPad.